When children & grandchildren inherit: per stirpes, per capita, and more—Part 2

Choosing “Something Else”

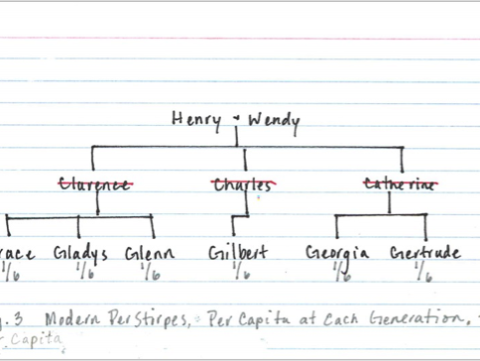

Previously , we distinguished English per stirpes from the other distribution methods. In the scenario in Part 1, in which all of Henry and Wendy’s children die before them, the allocation methods other than English per stirpes all produced the same result. In this post, we’ll use a different set of circumstances to differentiate the allocation methods other than English per stirpes.

Let’s assume that when Henry and Wendy die, Clarence and Charles are already deceased, but Catherine is still living.

Here is how the couple’s property would be allocated if their wills or trusts directed property to be allocated by the modern per stirpes method:

As Fig. 4 shows, the modern per stirpes method would result in an allocation that looks something like the English per stirpes allocation. Henry and Wendy’s property would be divided into shares at the closest generation with a living descendant (their children’s generation). A one-third share would be distributed to Catherine, and the other one-third shares are distributed down the lines of each of the other children. Clarence’s children share his one-third, and Charles’s child receives his one-third. Ultimately, the grandchildren end up with unequal proportions of their grandparents’ estate. The modern per stirpes method treats each line of descendants equally, but it determines lines using the closest generation in which someone is living.

Modern per stirpes is the default option in the law of Virginia and many other states. If a person dies as a resident of Virginia without a will or trust, that person’s property is allocated among his or her descendants by the modern per stirpes method.

Here is how the couple’s property would be allocated if their wills or trusts directed property to be allocated by the per capita at each generation method:

As Fig. 5 shows, a per capita at each generation allocation would result in each grandchild without a living parent receiving an equal amount. The property would be divided into shares at the closest generation with a living descendant (the children’s generation). A one-third shares would be distributed to Catherine. The shares of the deceased children (Clarence and Charles) would be combined and re-divided into equal shares for the children of Clarence and Charles. So, the children of Clarence and Charles would receive equal amounts. The per capita at each generation method aims to treat descendants in the same generation equally. Law students are taught to remember the per capita at each generation principle as “equally near means equally dear.”

Here is how the couple’s property would be allocated if their wills or trusts directed property to be allocated by the pure per capita method:

As Fig. 6 shows, a pure per capita allocation would result in Henry and Wendy’s property being divided equally among their living descendants. Catherine and each of Clarence’s and Charles’s children would receive equal shares. The pure per capita allocation does not appeal to many people.

As Fig. 6 shows, a pure per capita allocation would result in Henry and Wendy’s property being divided equally among their living descendants. Catherine and each of Clarence’s and Charles’s children would receive equal shares. The pure per capita allocation does not appeal to many people.

Fairness has a Price

At this point, it may seem that the modern per stirpes or per capita at each generation allocation is the most fair. That may be the case. But, in all methods other than English per stirpes, the order of deaths can play a significant role in how much each person receives.

With an English per stirpes distribution, the shares of each descendant will always be determined by how many children you have and which line a grandchild is in. Query whether that is right or fair, but it is consistent and predictable.

With modern per stirpes, per capita at each generation, and per capita, the order in which people die plays a role in how much each descendant receives. Consider the following examples:

Example 1: Consider Gilbert’s inheritance under the modern per stirpes allocation method. If Catherine is already deceased when Henry and Wendy die, Gilbert gets 1/6 of Henry’s and Wendy’s property (Fig. 3). However, if Catherine is living, Gilbert gets 1/3 of Henry’s and Wendy’s property (Fig. 4).

Example 2: Consider Georgia’s inheritance under the per capita at each generation method. If all of Henry and Wendy’s children are deceased, Georgia gets 1/6 (Fig. 3). Georgia receives nothing if Catherine survives (Fig. 5). If Charles, rather than Catherine, were to survive Henry and Wendy in Fig. 5, Georgia would receive 2/15 instead of 1/6.

Under the modern per stirpes, per capita at each generation, and per capita allocation methods, the amounts of Henry’s and Wendy’s property that each grandchild receives depends on which of the children happen to be living when Henry and Wendy die. Having shares determined by order of death is a necessary consequence of these distribution methods. The distribution method in which the order of deaths matters least is English per stirpes.

The post When children & grandchildren inherit: per stirpes, per capita, and more—Part 2 appeared first on Yates Campbell LLP.